Crypto for beginners feels exciting — right up until your account’s frozen, the fees pile up, or worse… your coins vanish. It’s not bad luck. It’s bad setup. Most Aussies fumble their first few steps and never recover.

This article gives you the cheat sheet they never had. 7 mistakes to skip if you want to start strong, stay secure, and actually make it to your first win.

#1: ❌ Don’t jump on the first exchange you see on Google

Signing up to a crypto exchange takes five minutes. Choosing the right one should take a bit longer. A lot of beginners get sucked in by a clean interface and forget to check what’s under the hood. Things like support, withdrawal fees, or how secure it actually is.

If you’re in Australia, you also want:

- Local bank deposit support (PayID, OSKO, etc.)

- Clear compliance with Aussie KYC/AML rules

- Reasonable AUD trading pairs (not just USDT)

- No shady offshore vibes.

✅ Don’t Let Google Decide for You. Fast sign-up is nice, but fast regret is worse.

#2: ❌ Don’t skip the security setup just to “have a look”

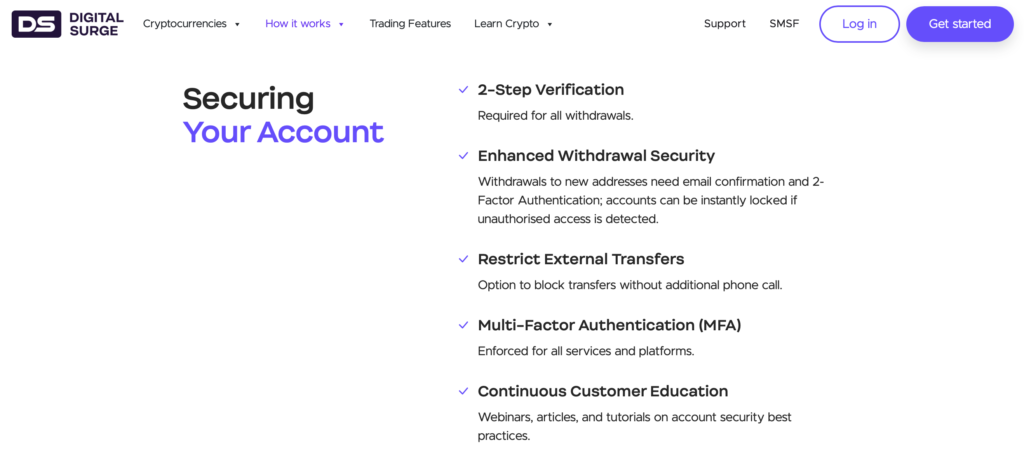

We’ve all done it. You just want to poke around, check out the exchange, maybe chuck a $50. You think, “I’ll sort security out later.” That’s a mistake.

Don’t treat it like Netflix. Logging in without 2FA, using the same password you’ve used since 2012, or skipping backups? That’s how to lose funds before you’ve even started.

Here’s what to do straight away:

✔ Turn on 2FA using an app (like Google Authenticator)

✔ Use a strong, unique password

✔ Don’t reuse login details from other sites

✔ Keep screenshots of backup codes in a safe place (not your email).

✅ Set It Up Before You Stuff It Up. 5 minutes now could save you 5k later. Literally.

#3: ❌ Don’t assume “low fees” means what you think it means

Crypto exchanges love flashing their “low fees” like it’s a badge of honour. But if you’re not careful, that little number becomes a big trap.

Here’s how it works:

They advertise 0.1% fees — but quietly build costs into deposit charges, inflated spreads, or withdrawal limits that punish smaller users. You think you’re saving, but you’re bleeding cash in the background.

So, before you trust the headline:

✔ Check the real purchase price vs the live market rate

✔ Review fee pages for deposit/withdrawal costs

✔ Test with a small buy and compare what you actually got.

Fees matter. But total cost matters more.

✅ In short, low fees are just the bait. Always look at the big picture, not just the bold text on the home page.

#4: ❌ Don’t buy $200 of a coin you heard about on TikTok

FOMO is a killer. One scroll through TikTok or Twitter and suddenly you’re convinced that some random altcoin is your ticket to freedom. Spoiler: it’s probably not. It’s probably already pumped — and someone’s waiting for newbies like you to buy in so they can cash out.

Ask one question before buying anything: Why does this coin exist — and what problem does it solve?

(Seriously, just Google it — if the answer’s ‘community vibes’ and not much else, keep your $200).

Start with assets that have actual use cases. Get comfortable with how the market moves. Then, if you still want to dabble in meme coins later, at least you’ll know the risks.

✅ Don’t Let FOMO Make Your First Trade. Crypto for beginners isn’t about catching the moon shot. It’s about building a solid base so you’re still in the game when the real opportunities come.

#5: ❌ Don’t leave everything on the exchange

Think of exchanges like public toilets: handy when you need them, but you don’t hang around longer than necessary. Leaving your crypto there is like leaving cash at the servo counter — it’s just not smart.

Beginners often assume their coins are safe because the platform “looks professional.” But hacks happen. Outages happen. Whole platforms collapse.

So, keep your trades on exchanges. Move your savings off.

- Use a software wallet for small balances

- Use a hardware wallet for serious holdings

- Always back up your wallet details offline

✅ Exchanges Aren’t Banks (And They’re Not Meant to Be). If you don’t own the keys, you don’t own the crypto. That’s the rule.

#6: ❌ Don’t wait until EOFY to think about tax

The one thing everyone wants to ignore until it’s too late… and no, its not leg day.

A lot of crypto beginners think tax is something you’ll “figure out later.” But later creeps up fast, and the ATO won’t accept confusion as an excuse.

Every buy, sell, swap, or transfer? That’s a potential tax event. Even just sending crypto to another wallet can trigger reporting.

Save yourself the stress:

✔ Use one exchange as much as possible early on

✔ Sync with a tax tool (like Koinly or CryptoTaxCalculator) to auto-track your history

✔ Label every transaction when it happens — not six months later.

✅ Crypto Tax Is Real — Whether You Like It or Not. Avoiding tax headaches is about being prepared, not lucky.

#7: ❌ Don’t Trust Everything You Hear (Even From Us)

You’ll hear a lot of hype in crypto. Big promises. Guaranteed gains. “Insider” tips. But if someone’s yelling about a coin, there’s a good chance they’re already holding it — and hoping you’ll drive the price up.

Your one job? Don’t get played:

✔ Look for transparency over bravado

✔ Learn the basics so you don’t need to rely on anyone

✔ And trust your instincts — if it feels off, it probably is.

✅ Build Your BS Radar Early. Take advice as a starting point — not a roadmap.

Now You Know — Make Your First Step a Smart One

You don’t need to be a pro to start with confidence. You just need to avoid the traps that trip up most Aussies. Now you’ve seen the 7 big ones, you’re already ahead of the pack.

Remember: crypto isn’t about rushing in. It’s about smart moves, steady progress, and setting yourself up to win long-term. Because crypto will be around for a long, long time.

Start by picking the right exchange, setting up your security, and making your first buy with purpose — not panic. The rest? You’ll learn as you go.