Some crypto sites make big promises. Zero fees! Fast payouts! Top security! But do they really deliver? It’s always smart to see if their words match reality. This Independent Reserve Review shows you what to expect from one of Australia’s long-standing crypto exchanges.

We’ll look at the real fees and security features. And whether it’s a smart choice for Aussie traders in 2025.

What Is Independent Reserve?

Let’s be real, crypto exchanges can feel like the wild west. Many are a headache to use and hide high fees or security risks. Others, like Independent Reserve, are open, trusted, and built for Australians who want piece of mind.

Since 2013, this exchange has helped 400,000+ Aussies buy and sell crypto in a safe way. It follows strict rules and keeps fees low. It also makes it easy to deposit AUD, so you can avoid extra hassles.

Pros & Cons of Independent Reserve

Independent Reserve has a lot going for it, but it’s not without its downsides. Here’s the good and the not-so-good, and what you need to know.

✅ What’s Awesome

- Rock-solid security – Fully regulated, AUSTRAC-registered, and insured.

- Easy bank deposits – Supports AUD, NZD, USD, and SGD.

- Better deals for big traders– The more you trade, the lower your fees.

- Good for serious investors – Has an OTC desk for large orders.

❌ What Could Be Better?

- Limited crypto selection – Fewer altcoins than Swyftx or Binance.

- Higher fees for casual traders – Not the cheapest option if you only trade small amounts.

- Slower support – Email only, no live chat.

Who Should Use Independent Reserve?

This exchange is great for beginners who want a safe, well-regulated place to trade. It follows strict financial rules, offers insurance on some assets, and lets you deposit AUD from your bank. You won’t have to worry about shady offshore platforms or sketchy withdrawal policies here.

It’s also ideal for frequent traders. The more you trade, the lower your fees. And if you make large transactions, you can use the OTC desk for better rates without big price jumps.

That said, if you love chasing new tokens, you may find the coin list limited. It offers key cryptos like Bitcoin, Ethereum, and XRP, but not as many options as Binance or Swyftx.

Also, if fast customer support is a priority for you, keep in mind that you can only reach them by email. There’s no live chat.

Independent Reserve’s Trading Features

Of course when you trade, you need more than just a buy button. You need tools that make your life easier. Independent Reserve gives you some handy tools:

🔹 Market & Limit Orders – If you’re the “get in now” type, market orders are instant. If you’re the patient type, limit orders let you wait for the perfect price.

🔹 OTC Desk for Big Trades – Get better rates on large orders without wild price swings.

🔹 API Access for the Pros– Trade with bots or automated strategies while you sleep.

🔹 Auto DCA (Set & Forget) – Stop worrying about timing the market. Set up regular buys to build your crypto stash over time.

🔹 Tax-Friendly Reporting – No one likes tracking trades manually. Independent Reserve helps you generate clear reports to stay on top of your taxes.

Independent Reserve Fees & Costs

Nobody likes confusing fee structures, so let’s break it down in plain English. Independent Reserve charges fees based on how much you trade, meaning bigger traders get lower fees.

- Trading Fees – Start at 0.5% per trade. They drop as your total trading goes up. High-volume traders can pay as low as 0.02% per trade.

- Deposit Fees

- AUD deposits via PayID & NPP – Free (nice and easy).

- Bank transfers via SWIFT – $15 AUD fee (avoid if possible).

- Withdrawal Fees

- AUD bank withdrawals – Free.

- Crypto withdrawals – Vary by coin (e.g. Bitcoin: 0.0003 BTC).

- Hidden Costs? – Nope! But remember that spreads affect your final buy or sell price.

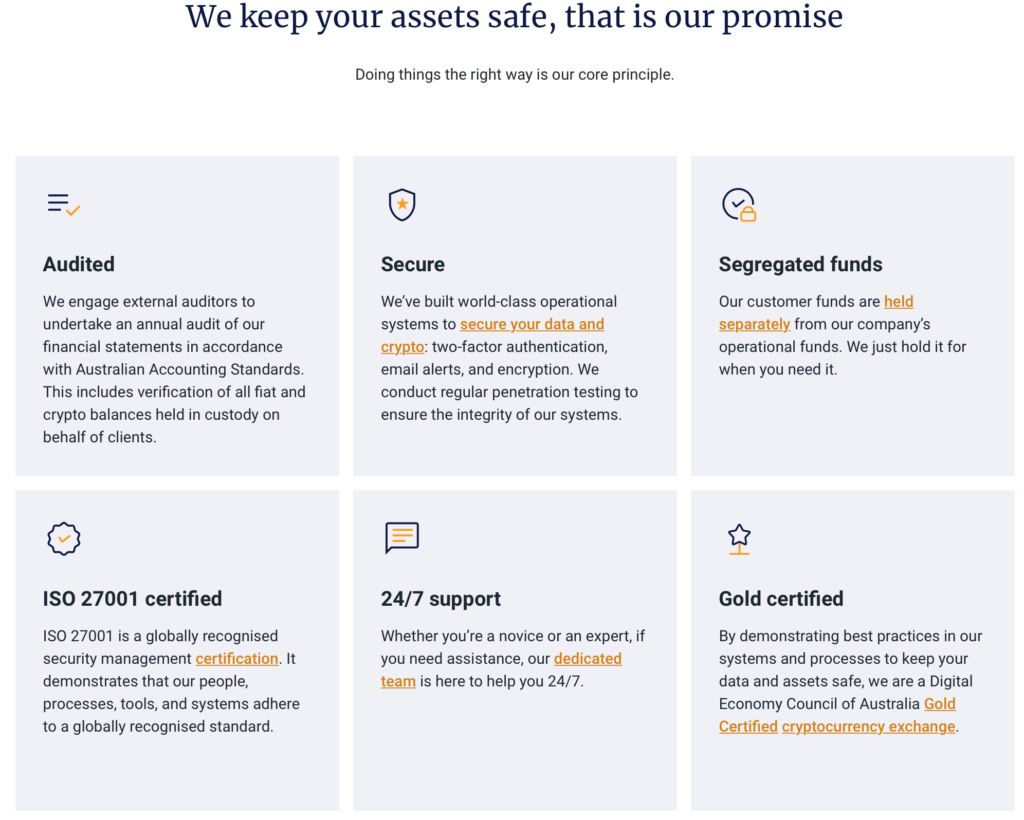

Security & Regulation

Security in crypto is no joke. You want to know that your money is safe. Independent Reserve does a lot to keep your funds safe.

For starters, it’s fully registered with AUSTRAC, so it follows strict Australian financial rules. This isn’t some sketchy offshore exchange that can disappear overnight.

Your crypto is also kept in cold storage, stored offline where hackers can’t get to it. That’s a big plus in an industry where cyberattacks are a real threat.

What happens if something goes wrong? Independent Reserve offers insurance on some digital assets. If you ever lose funds due to a security breach, you’ve got an extra layer of protection.

Two-factor authentication (2FA) is required for logging in and withdrawing funds. No 2FA, no access—simple as that.

Best of all, Independent Reserve has never been hacked since it launched in 2013. That’s impressive, considering how many exchanges have suffered security breaches over the years.

Customer Support & User Experience

Independent Reserve is simple to use, but it leans toward users with some trading know-how. If you’re brand new to crypto, you might prefer Swyftx or CoinSpot for their beginner-friendly layouts.

A mobile app is available for iOS and Android, though it’s not as feature-rich as some others.

Customer service is email-only, so no phone or live chat. The good news is that response times are decent, and there’s a helpful knowledge base on the site.

Independent Reserve has a 3.2/5 rating on TrustPilot and a 3.1/5 on ProductReview.

Independent Reserve vs Competitors

Still not sure if Independent Reserve is the right exchange for you? Here’s a quick look at how it compares to other popular platforms:

| Feature | Independent Reserve | Binance | Swyftx | CoinSpot | Coinbase |

|---|---|---|---|---|---|

| Regulated in Australia? | ✅ Yes | ❌ No | ✅ Yes | ✅ Yes | ❌ No (U.S.-based) |

| Trading Fees | 0.5% (goes down to 0.02%) | 0.1% | 0.6% | 1% (instant) | 0.5% + spread |

| Deposit Methods | Bank transfer, PayID, SWIFT | Bank transfer, PayID, credit card | Bank transfer, PayID | Bank transfer, PayID, BPAY, cash | Bank transfer, PayID, debit card |

| Number of Cryptos | 30+ | 350+ | 320+ | 400+ | 250+ |

| Security Features | Cold storage, 2FA, insurance | Cold storage, 2FA | Cold storage, 2FA | Cold storage, 2FA | Cold storage, 2FA, FDIC insurance (USD funds) |

| Customer Support | Email only | Live chat, email | Live chat, email, phone | Live chat, email, phone | Email, live chat, phone (select regions) |

| Best For | Security-focused traders | Low fees, altcoin variety | Beginners | Simple, beginner-friendly | U.S. users, easy interface |

If you want strong security and Australian regulation, Independent Reserve is a solid choice. But if you want the absolute lowest fees (Binance) or a wider altcoin range (Swyftx & CoinSpot), look elsewhere. Coinbase is fine for U.S. users but often has higher fees.

How to Get Started with Independent Reserve

Signing up is quick:

- Sign Up – Go to the Independent Reserve site, create an account, and choose a strong password.

- Verify Your Identity – Since it’s a regulated exchange, you’ll need to do KYC by uploading ID and proof of address.

- Deposit Funds – Add AUD, NZD, USD, or SGD via PayID (free), bank transfer, or SWIFT.

- Start Trading – Pick from 30+ cryptos and place a market or limit order.

- Enable 2FA – Protect your account by turning on two-factor authentication.

Conclusion: Is Independent Reserve Worth It?

Independent Reserve isn’t perfect. It doesn’t have a huge list of altcoins and may not offer the cheapest fees for small trades. But if you care about security, regulation, and reliability it’s one of the best exchanges in Australia.

You get strong security, insurance on some assets, a clean interface, and quick bank transfers. No flashy gimmicks. Just a safe and straightforward way to buy, sell, and trade crypto.

If you want a trusted exchange and peace of mind, Independent Reserve is absolutely worth it.