CoinSpot is one of Australia’s most trusted cryptocurrency exchanges, known for its beginner-friendly design and strong security measures. With access to a wide selection of coins, along with features like NFT trading and crypto bundles, it’s made for simplicity and variety. While its instant trade fees are higher than some competitors, CoinSpot’s ease of use and compliance with Australian regulations make it a standout choice for local traders. This CoinSpot review will cover everything you need to decide if it’s the right choice for you.

Join CoinSpot and start trading

Key Highlights

Advantages

- User-Friendly Interface: Designed for ease of use, making it great for beginners.

- Strong Security Features: Offers cold storage, two-factor authentication, and AUSTRAC compliance for enhanced security and data privacy.

- Wide Cryptocurrency Selection: Access to over 500 digital assets, including major coins and niche altcoins.

Disadvantages

- Higher Instant Trade Fees: A flat 1% fee for instant buy and sell transactions, higher than some competitors.

- Limited Advanced Trading Tools: Lacks features like margin trading or futures for experienced traders.

- Cash Deposit Fees: A 2.5% fee for cash deposits at participating news agencies, which could be a problem for some users.

Overview of CoinSpot

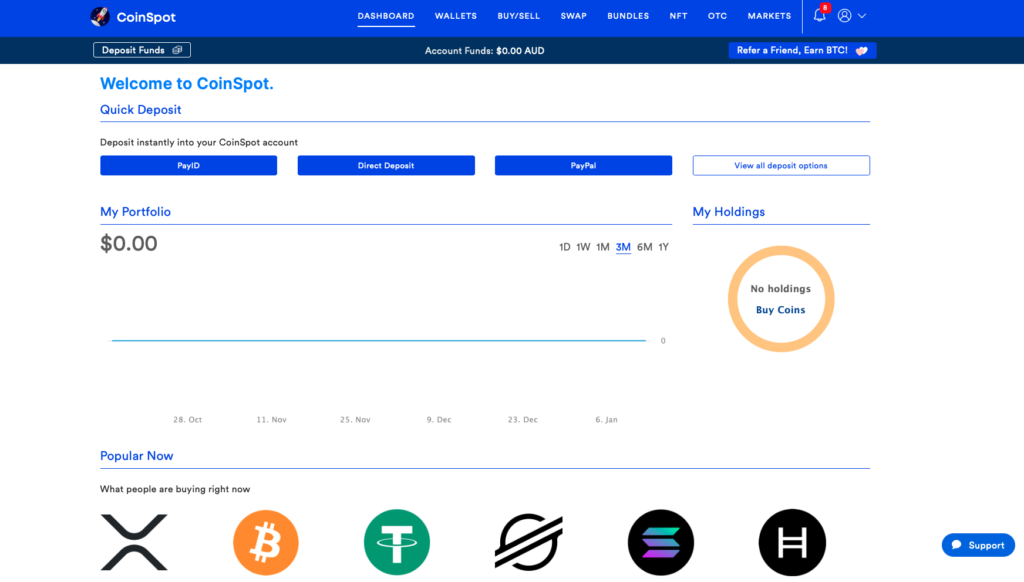

CoinSpot has become one of Australia’s leading cryptocurrency exchanges since its launch in 2013. Its focus on simplicity and security has made it a popular choice for beginners and casual traders, with over 2.5 million users on the platform. CoinSpot features instant buy and sell options, staking, and an NFT marketplace for a straightforward trading experience.

While its user-friendly design appeals to new traders, CoinSpot’s higher fees for instant transactions may be less attractive to those looking for more advanced trading tools. Despite this, its commitment to compliance with Australian regulations and strong security measures makes it a reliable and secure platform for customers.

Cryptocurrencies Available

CoinSpot offers access to over 500 cryptocurrencies, including popular options like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Solana (SOL).

The platform also allows fiat-to-crypto transactions in Australian Dollars (AUD), making it convenient for local users to start trading. Whether you’re interested in well-known coins or exploring niche altcoins, CoinSpot makes it convenient to buy or sell many digital assets.

Trading Features

CoinSpot caters to crypto traders with these tools:

- Market Orders: Make trades at the current market price for quick and simple execution.

- Crypto Bundles: Buy a collection of coins in one transaction, making it easy to diversify.

- Staking Options: Earn passive rewards by staking supported coins directly on the platform.

- NFT Marketplace: Access a built-in marketplace to trade non-fungible tokens (NFTs).

- Seamless Access: Manage your portfolio on both desktop and mobile platforms, allowing trading anytime, anywhere.

CoinSpot doesn’t offer advanced trading tools like margin trading or futures. However, if you are simply after a straightforward trading experience, its intuitive interface makes it the ideal platform.

Coinspot Fees

CoinSpot offers clear pricing with no hidden charges. Here’s an overview of the main fees:

- Instant Buy and Sell: A flat fee of 1% per transaction for instant trades, for users who prefer quick transactions.

- Market Orders: A lower fee of 0.1% per transaction, for traders looking to save on costs.

- Deposit Fees: PayID and POLi deposits are free, there is a 0.9% fee for BPAY deposits, and a 2.5% fee for cash deposits.

- Withdrawal Fees: Free AUD withdrawals to Australian bank accounts. Network fees for cryptocurrency withdrawals which differ by asset.

Security Features

CoinSpot takes security seriously with best-practice protections for user funds and data. The platform has built a strong reputation for its compliance with Australian regulations. Key security features include:

- Cold Storage: User funds are stored offline in secure cold wallets, which lowers the risk of online breaches.

- Two-Factor Authentication (2FA): An extra layer of security for account access.

- Custom Withdrawal Restrictions: Option to use features like address whitelisting which ensure that withdrawals are only sent to pre-approved addresses.

- SSL Encryption: Protects user data and secures communication between the platform and its users.

- AUSTRAC Compliance: CoinSpot is registered with AUSTRAC which means it is bound by strict anti-money laundering regulations.

Customer Support and User Experience

CoinSpot offers its customers support through live chat, email, and a Help Centre with guides and FAQs.

While most reviews are positive, some feedback highlights occasional delays in support response times during peak periods. Overall, CoinSpot provides accessible support and a user-friendly experience.

How to Open a CoinSpot Account

Getting started with CoinSpot is straightforward. Follow these simple steps:

- Visit the CoinSpot Website: Go to the CoinSpot website and click on “Register.”

- Enter Details and Verify Identity: Provide your email, create a password, and complete the KYC process.

- Enable Two-Factor Authentication (2FA): Add an extra layer of security to your account.

- Deposit Funds and Start Trading: Link your payment method, deposit AUD, and begin trading.

Final Verdict

CoinSpot is a secure and beginner-friendly platform, making it a top choice for Australian investors. With a simple interface, a wide range of coins, and strong security features, it’s great for newcomers and casual users. However, more experienced traders may consider the lack of margin and future trading and the relatively high instant trade fees to be drawbacks.